Key Person Insurance

Key Person Insurance

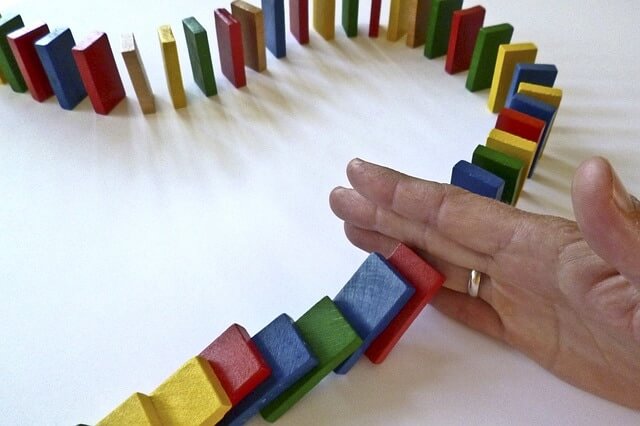

Key person insurance ensures your business can survive without key people

A key person in your business provides the ideas, drive, initiative and particular skills that generate revenues and profits needed for financial survival and growth.

Who is a key person?

They could be

- The founder and owner of a business who provides direction, momentum and builds reputation.

- A specialist, such as a designer whose skills are vital to business success

- A top sales person who builds key relationships and business contacts.

What happens when you lose a key person?

Revenue

A direct impact on sales can occur due to the loss of a key staff member meaning reduced revenue.

Expenses

You may have additional expenses due to needing to fund a replacement

Relationships and Contacts

You may experience a loss of key clients due to the loss of a critical staff member responsible for that relationship.

What is the Solution?

Develop a Key Person Insurance plan that provides cash flow to offset the impact on revenue by providing artificial revenue through a monthly benefit while the key person cannot work due to illness or injury. This could be to fund fixed expenses or fund a replacement employee.